Chronic Disease Management Strategies for Quality Living and Self-Care

Chronic disease management is a key element of effective health outcomes. It involves a variety of clinical resources, including support groups, nutritionists, chaplains, and physical therapists. These interventions can improve patient outcomes and satisfaction.

Self-management includes a range of tasks and skills that encompass emotional processing, adjusting, and integrating illness into daily life. This can help individuals better cope with their illnesses and achieve a sense of control over their care.

Team-based care

The guiding principle behind team-based care is to give patients the tools they need to manage their health. This can be done by implementing a plan of action that includes a trusted care team, self-management strategies and access to community support services. This model will help reduce the physical, emotional and social consequences of chronic illness for individuals and their families.

The goal is to help patients manage their symptoms and achieve the best possible quality of life. This can be achieved by incorporating a holistic approach to managing the disease, including lifestyle changes and patient education. It is also important to make sure that a patient’s needs are being met. For example, a person living in a food desert will have trouble adhering to a specific diet, while an individual with financial problems may struggle to pay for their medications.

People with chronic conditions can join self-management support groups to gain the knowledge and confidence to be their own advocate. These groups can be accessed in person or online.

Self-care

Many people who live with chronic diseases struggle to manage their care and maintain a good quality of life. They may have trouble keeping up with appointments, eating well, and getting enough sleep. They also have to keep up with their medication. Self-care strategies can help them do these things.

It’s important for patients to learn as much as they can about their condition and how to manage it. They should be able to communicate with their healthcare team and ask questions when they need help. It’s also important to practice healthy lifestyle habits, like eating a nutritious diet and exercising regularly.

Disease management programs are proactive, organized sets of interventions designed to meet the needs of a defined population of patients with conditions for which self-care is important. These programs can provide support for health care professionals in their efforts to promote self-care. They can also help patients take a more active role in their care and treatment.

Medication management

While there are many different treatment modalities to manage chronic conditions, prescription medications play a vital role in most patients’ care. Diabetic patients, for example, often require a complex medication regimen to manage their disease, with many medications both directly treating their disease (such as insulin) and helping to prevent downstream complications (such as statins).

A trusted care team that understands a patient’s condition, medication and need for adherence is essential to improving quality of life. In addition, ensuring that a patient can afford their medications is a critical component to chronic care management. For instance, studies suggest that social determinants of health, such as low income or lack of transportation, can be significant barriers to medication adherence.

Medication optimization is an important part of managing a patient’s chronic disease, and Arine’s tools help ensure that a member’s regimen is as simple as possible. To learn more, register for our upcoming webinar, Medication Optimization: The Missing Link in Value-Based Care.

Self-management support groups

Self-management support is an important strategy to help patients with chronic health conditions manage their symptoms and maintain a healthy lifestyle. Studies show that well-implemented self-management interventions can improve patient outcomes and lower healthcare costs. They also have the potential to improve quality of life and bolster clinician engagement.

However, it is important to note that self-management supports are not effective on their own. They must be integrated into a trusted care team. This can include a primary care physician, a nurse, a social worker and an allied health professional. It may also include community resources and support groups.

One example is the Expert Patients program, a six-session group intervention designed to teach participants how to control their chronic disease. The workshop is taught by two facilitators, at least one of whom has a chronic condition. The program is offered to individuals who have been referred by their healthcare providers or are self-referred. The program is standardized and includes manuals for leaders, master trainers, and T-trainers.

Read MoreBreaking Down Common Health Myths Separating Fact From Fiction

As scientists discover new information, long-held beliefs are sometimes debunked. NewYork-Presbyterian experts take a look at some common health myths and separate fact from fiction.

Being able to evaluate the credibility of health-related news and information has never been more important. Learn how to identify reputable sources and avoid misinformation.

1. Measles is a contagious disease

Measles is an extremely contagious, serious and highly infectious viral disease that causes a red rash and fever. It used to be common in the United States but has become rare since the development of a vaccine and widespread vaccination. The virus is easily transmitted through the air by coughing or sneezing. It can also spread through direct contact with an infected person or a contaminated surface.

Complications from measles include blindness, brain swelling (encephalitis), severe diarrhoea and dehydration, ear infections and respiratory infections such as pneumonia. It is also very dangerous for pregnant women and their babies. It is especially severe for malnourished young children, those with insufficient vitamin A or people with weak immune systems from diseases like HIV/AIDS.

Measles is so contagious that if one unvaccinated person has it, nine out of 10 people who are close to him or her will get the infection too. The virus is spread through the air by infected droplets that spray into the air when a sick person coughs or sneezes. The droplets can land on surfaces and remain infectious for two hours.

2. The flu shot causes the flu

Many people get the flu shot each year, protecting them against one of the most serious respiratory illnesses. However, there are still myths surrounding the vaccine that need to be addressed.

The flu shot cannot cause the flu, as it does not contain any living viruses. It only contains inactivated or killed flu viruses or a single protein from the virus, which is not infectious. The symptoms you may experience a day or two after the shot are due to your body’s immune response and are not the flu itself.

Getting the flu can lead to serious complications and even death, especially in people at higher risk for serious symptoms, such as infants, older adults, and those with medical conditions like asthma or diabetes. While the vaccine can’t prevent all cases of influenza, it does significantly reduce the number of deaths and hospital stays caused by the virus. And it’s important to remember that the vaccine must be re-shot each year because the flu virus changes (mutates) each season.

3. Vaccines cause autism

The vaccines that protect kids from diseases like measles, mumps and rubella are not only effective but also safe. Unfortunately, media reports and activist groups have been successful at scaring parents into believing that vaccines cause autism. By refusing vaccination, parents leave their children vulnerable to resurgent and potentially deadly childhood illnesses.

In the 1990s, British doctor Andrew Wakefield published a paper in The Lancet linking measles, mumps and rubella (MMR) vaccines to autism. His work was based on fraudulent research and he later lost his medical license. Since then, many studies have found no link between vaccines and autism. But the myth persists. The idea of a vaccine-autism link fits people’s tendency to search for patterns in complex and confusing situations. This cognitive bias is why some parents continue to refuse vaccination, putting their children at risk for serious and often fatal diseases. Moreover, avoiding vaccines exposes others in the community to resurgent disease, too.

4. Drinking water makes you lose weight

Drinking water helps keep the body hydrated, which is important for many bodily functions. However, drinking water does not automatically lead to weight loss. If you are trying to lose weight, the most effective way to do so is through a balanced diet and exercise.

Some studies have found that drinking water reduces appetite, but these are limited to young healthy adults. One reason for this may be that when the stomach is full of water, there is less room for food, and people eat fewer calories.

In addition, drinking too much water can cause a dangerous imbalance of electrolytes and lead to water intoxication. So, while it is beneficial to drink water throughout the day, it should not be used as a substitute for other calorie-free beverages.

Read MoreMen’s Health Guide – Essential Tips for Maintaining Physical and Mental Well-Being

Men often only visit a doctor when they feel sick, which is why preventative healthcare and yearly wellness exams are so important. This includes getting regular vaccinations and screenings that detect conditions like heart disease, prostate cancer and diabetes.

A healthy diet is also essential. It should include a variety of nutrients, and avoid unhealthy habits such as smoking and excessive alcohol consumption.

1. Exercise Regularly

Exercise and physical activity offer a host of benefits, from improved mental health to better weight management. Men should aim for at least 30 minutes of moderate intensity workouts each day, which can include jogging, swimming, cycling, or even walking.

These healthy living tips can help men make preventive healthcare a priority. This includes getting regular check-ups and avoiding harmful habits like smoking.

2. Eat Healthy

Men should eat plenty of nutrient-rich foods, such as vegetables, fruits, whole grains, lean proteins and healthy fats. They should also drink enough water.

Heart disease is the leading cause of death among men, and regular physical activity, a heart-healthy diet and stress management can help to prevent it.

Men should also get regular checkups and wellness visits each year. These checks should include cholesterol and blood pressure evaluations.

3. Get Enough Sleep

Sleep is a critical part of life for all of us. It is a time when the body repairs itself, consolidates memories and releases growth hormones.

To get enough sleep, try to go to bed and wake up around the same time every day (including weekends). This will help synchronize your internal clock and improve your sleep quality. Aim for 7-9 hours of restful sleep per night.

4. Stay Active

Men need to stay active and make healthy food choices. They also need to get regular checkups, including cholesterol and blood pressure evaluations.

Being healthy is a lifelong journey that requires commitment and dedication. Our guide to men’s health will help you prioritize your well-being and build healthy habits that last a lifetime. This includes practicing testicle self-checks, getting regular vaccinations and undergoing routine screenings.

5. Manage Stress

Whether you’re frazzled from your morning commute or exhausted from a stressful meeting at work, there are many ways to relieve stress. Taking a deep breath, seeing a picture of your loved ones, listening to soothing music or focusing on a hobby are some great ways to reduce your stress levels.

If self-care measures don’t ease your symptoms, it may be time to see a mental health professional. Remember, seeking help is a sign of strength, not weakness.

6. Stay Connected

Men are often encouraged to be stoic and emotionally detached, but this can take a toll on their mental health. Staying connected by spending time with your friends and family, listening to them, and showing empathy can help you feel more resilient.

Men’s health is essential to a happy and fulfilling life. Learn how to keep yourself healthy and seek help when needed.

7. Seek Help When Needed

Men can often find themselves juggling work, family and other obligations. It’s easy for health concerns to fall by the wayside, but it’s important to make time to get regular check-ups and screenings.

It’s also important to recognize the impact that mental health can have on overall wellbeing. Seeking professional help is a sign of strength, not weakness. It can help you feel better and live a longer, healthier life.

8. Take Care of Yourself

Getting regular check-ups is an important aspect of men’s health. It can help detect issues in their early stages and reduce the risk of serious complications.

It’s also important to take care of yourself mentally. Maintaining meaningful relationships, eating a balanced diet, practicing stress management techniques and getting enough sleep can improve your mental wellness. Getting help when needed is crucial as well.

9. Get Regular Check-Ups

Getting regular check-ups helps find health conditions or diseases early, giving you the best chance of getting treatment and living a long, healthy life. Everyone is unique, so getting a personal preventative plan tailored to your specific risk factors and medical history is vital.

Men are more prone to certain diseases, such as cardiovascular disease and prostate cancer, so making healthcare a priority is essential.

10. Take Care of Your Mental Health

The way you feel about yourself and your life can have a profound effect on your physical health. It’s also important to recognize early warning signs and seek help if you need it.

Make preventive health care a priority by getting regular check-ups, staying up to date on vaccines and screenings, and practicing healthy habits like getting enough sleep, reducing stress, and avoiding too much alcohol.

Read MoreEmpowering Women in Taking Control of Their Health

Women make up half of every nation’s population, yet are often overlooked in terms of health care and services. This imbalance translates into poorer health outcomes.

It’s time to address this inequality by focusing on women’s health. To do so, we need to tackle neglected diseases and build robust health systems.

Reproductive Health

Women’s health concerns are complex and diverse. They are affected by a variety of factors, including their biology, environment and lifestyle choices. Women can take control of their health by making healthy choices, seeking support, and prioritising their unique needs.

The right to health includes access to contraception, and for women to choose a method that suits them. This is especially important for disadvantaged women who are less likely to be reached proactively by services.

Women should also be able to access breast and cervical cancer screening. Detecting these diseases at an early stage can help save lives. Additionally, women should have access to vaccines like the human papilloma virus (HPV) and other preventative healthcare like regular STI testing.

Menstrual Health

Menstrual health is about more than just sanitary products. It encompasses the entire experience of menstruation for 1.9 billion girls, women, transgender and nonbinary people each month – including access to information, supplies, water, sanitation and hygienic disposal facilities; a supportive environment; and competent healthcare workers. It is also about tackling the stigma and taboos associated with menstruation, which can prevent people from achieving good menstrual hygiene, living in dignity and participating fully in their lives.

Gender inequality, discriminatory social norms, poverty and lack of basic services like toilets and sanitary products can all cause women’s menstrual needs to go unmet. This has far-reaching consequences, affecting their ability to participate in school, work and community life. Our Côte d’Ivoire partners, Soutien Aux Meres et aux Enfants en Détresse de Cote d’Ivoire and Actuelles, are working to change this.

Mental Health

A woman’s mental health is just as important as her physical health. Throughout their lives, women encounter distinctive challenges and stress factors that can impact mental well-being.

Among these are: Life Transitions, including puberty, pregnancy, and menopause, which can trigger mood swings. Social pressures and expectations, such as those related to body image and gender roles, can also influence mental health.

In addition, the occurrence of trauma and violence against women can lead to a host of psychological issues like depression, anxiety, or post-traumatic stress disorder. And finally, a lack of access to quality health care and education can cause emotional problems such as low self-esteem or poor decision making.

Sexual Health

Having sexual health means having the ability to integrate and enjoy sexuality into your life, derive pleasure from it and have satisfying relationships, while avoiding unintended pregnancy and sexually transmitted diseases. This is inextricably bound to your physical and mental well-being.

A major obstacle to sexual health is violence against women – physical and emotional abuse, coercion and discrimination – which adversely affects their long-term wellbeing. In addition, many forms of sexually transmitted infections, including HIV and genital cancers such as HPV and chlamydia are particularly devastating for women’s health.

Physicians can empower their patients by taking a proactive approach to sexual health. This includes using a patient-centered history taking model, such as CDC’s Five Ps (partners, practices, past history of sexually transmitted diseases and protection and pregnancy prevention), and by training providers and staff to recognize individual implicit biases and provide trauma-informed care. Bayer is also committed to supporting innovation to promote sex- and gender-informed healthcare by enabling better data collection, research design and sex-intentional regulatory and science policy.

Read MoreCoping With Seasonal Changes

Our bodies change with the seasons. You may notice your skin gets drier, or your hair grows darker with less sun exposure.

Seasonal changes can also affect your immune system. The stress of changing weather conditions, juggling kids’ spring sports schedules and other events can lower your defenses against germs.

1. Get plenty of sleep

For many people, especially those in recovery, a shift in seasons can affect moods. Some feel a little blue as fall turns into winter, but others may be struggling with something more serious: seasonal affective disorder (SAD).

SAD is caused by lack of sunlight and can cause a variety of symptoms, including low energy, sleep problems, weight gain, depression, and irritability. To combat SAD, get plenty of rest each night. This means establishing a regular bedtime and sticking to it, even on the weekends, and prioritizing your sleep over other activities. Research shows that adults need between 7 and 9 hours of sleep per night. A good quality sleep will boost your mood, reduce stress, and improve immune system function. Try to spend the bulk of your time in REM sleep.

2. Stay active

For many people, the cooler temperatures and darker days can make it more difficult to get in enough physical activity. To maintain good health, experts recommend getting at least 150 minutes of heart-pumping activity each week.

It’s also a good idea to keep up with flexibility exercises such as stretching and yoga, which can help reduce stress and improve your mood. And, if you aren’t already using public transportation or walking to run errands in the warmer months, consider making it a winter habit.

Seasonal changes can be challenging for many people, especially those who have a mental illness like seasonal affective disorder (SAD). SAD occurs when less sunlight triggers a biochemical imbalance in the brain and leads to low energy and feelings of depression.

3. Eat healthy

As the seasons change, your diet should be a priority. Eating a balanced diet can help to keep your body in good condition and immune system strong. It is important to include a variety of foods from each food group as well as drink plenty of water.

It can be difficult to stay on track with your health goals during the fall and winter months. The shorter days can lead to less frequent exercise, which can make it easier to overindulge in unhealthy snacks and meals.

Try swapping your morning coffee for tea to cut down on caffeine. Tea has countless benefits and is a healthy alternative to coffee. Also, try to limit your alcohol intake. Drinking too much can cause dehydration and decrease your immunity.

4. Stay hydrated

Staying hydrated is essential, even during cold weather. Drinking water can prevent dehydration, which is a common cause of fatigue and headaches. It’s important to drink water throughout the day, especially before and after exercise. In addition, water-rich foods and beverages are a good choice, such as vegetables, fruit, soups, or decaffeinated unsweetened tea.

Thirst isn’t always the best indicator of dehydration, especially when you’re exercising in cooler weather or are not sweating as much. Aim for at least eight glasses of fluids daily, or about half your body weight in ounces.

Ranglani advises that you choose cooling foods and drinks during this time of year, such as cucumber, mint, basil seeds, betel leaf, coconut water, warm turmeric milk or household kadha. Avoid iced drinks that are high in sugar and calories.

5. Stay cool

Heat kills more people in the United States than any other weather hazard, and it’s only expected to get worse as global temperatures rise. To avoid the dangers of extreme heat, try to limit outdoor activity to the coolest parts of the day (like morning or evening), and be sure to take breaks in shade.

Choose cooling foods, like salads and fresh, raw vegetables. You can also eat icy treats, such as popsicles, frosted yogurt, or frozen fruit drinks. Drink water, but stay away from sugary drinks and caffeine, which can lead to dehydration.

If you can’t afford to use air conditioning, spend time in places with it, like libraries and malls. Menthol-containing products, such as mouthwash and cough drops, can also help you feel cooler.

Read MoreMaintaining Cardiovascular Health and Prevention

Cardiovascular disease is the world’s leading cause of death and is largely preventable. It can be caused by a number of risk factors including tobacco use, unhealthy diet and obesity, physical inactivity, harmful alcohol consumption and high blood pressure.

While genetics play a role, many cardiovascular disease risks can be controlled through heart-healthy choices and education. These include regular exercise, a healthy diet, not smoking, and managing stress and sleep.

Lifestyle Changes

Having good cardiovascular health requires a combination of healthy habits, like exercise, eating well and avoiding tobacco. Changing these habits can reduce your risk of heart disease, which includes coronary heart disease (CHD), stroke and arrhythmias.

You cannot change some risk factors for heart disease, such as family history or sex at birth. But you can change other risk factors, such as smoking, unhealthy eating habits and being overweight.

A healthy diet is one of the most important things you can do to prevent heart disease. The recommended diet is high in fruits, vegetables, low-fat dairy, fish, nontropical vegetable oils, nuts and whole grains. It should also be low in saturated and trans fats, added sugars, and salt.

It is recommended that you get 150 minutes of moderate exercise each week, such as walking or cycling. It is also important to have enough protein in your diet each day, and a registered dietitian can help you with meal planning if needed.

Diet

A person can significantly reduce their risk for heart disease by eating a balanced diet full of fruits and vegetables, whole grains, fish and lean meats, and healthy fats. A cardiac diet also limits salt, sugar and processed foods, and focuses on drinking only limited amounts of alcohol (if at all).

In addition to a well-balanced diet, a person can positively impact their heart health by exercising regularly. It is recommended that adults get 150 minutes of moderate intensity exercise each week, which can include activities such as walking, climbing stairs or taking the dog for a walk. Diet and exercise are two of the simplest ways to improve heart health, especially if a person wants to avoid developing heart disease due to factors that they cannot change such as family history or sex at birth. These five health measurements are a great place to start.

Exercise

One of the most important factors in maintaining a healthy heart is physical activity. Studies have shown that regular cardio-based exercise not only strengthens the heart muscle, but it also improves blood flow in the small vessels around the heart. This can help prevent blockages of fatty deposits that can build up over time and lead to heart attacks.

In addition to getting enough daily physical activity, it is important to choose the right type of foods to eat. Try to follow a heart-healthy eating plan such as the DASH diet or the Mediterranean diet. Both of these plans emphasize high intakes of vegetables and fruits, whole grains and lean meats. They limit consumption of refined sugars and saturated fat and include low-fat or fat-free dairy foods.

Choosing a healthy lifestyle at any age can decrease the risk of cardiovascular disease. Taking steps to reduce risk factors like obesity, unhealthy diet, lack of physical activity, smoking and high blood pressure or cholesterol can make a big difference.

Stress Management

Getting enough sleep, eating a healthy diet and managing stress can all help. However, if you find that your lifestyle doesn’t make much difference, it may be time to try a new approach.

For example, if you’re dealing with ongoing stress and don’t have good social support, it might be helpful to consider therapy or counseling. These techniques can help you find the sources of your stress and learn healthier ways to cope with them.

Some heart disease risk factors can’t be changed, such as being born with a family history of cardiovascular disease or age. However, other risk factors can be changed or managed, such as a healthy diet and exercise, avoiding tobacco and alcohol use and regular health screenings. Treatment options include medications, procedures and surgeries. Cardiovascular disease is a leading cause of death in the world and early diagnosis can lead to effective treatment. So, be proactive about your heart health.

Read MoreMastering Financial Literacy – Key Concepts and Skills Everyone Should Know

Having financial literacy skills is more important than ever before. This includes understanding how to make wise money management decisions and establishing healthy financial habits.

Mastering financial literacy involves learning the four spheres of personal finance: earning, spending, saving and investing. It also encompasses understanding income taxes and deductions, including retirement savings.

Spending

Many people struggle with achieving financial stability, and part of this is due to an inability to prioritize long-term goals. Cultivating financial literacy can help.

Financially literate individuals are comfortable preparing a budget, deciding favorable loan terms, and understanding the impact of credit and debt on their overall finances. They also know how to save using different investment vehicles for retirement.

When you’re a business owner, financial literacy is key to making wise decisions that set your company up for success. Using tools like Bold BI to make your business data accessible to employees without finance-specific education allows you to improve financial literacy within your company.

Saving

It’s important to save regularly, especially for emergency expenses and long-term goals. Being financially literate can help you make better choices about saving, employment, budgeting, and debt management. It can also reduce your financial anxiety, which leads to overall well-being.

Increasing your financial literacy can improve the way you manage money and protect yourself from fraud. It can help you spend wisely, invest responsibly, and avoid debt traps that can drain your paycheck and limit your future opportunities. It can even lead to more savings and better retirement plans, as well as a greater sense of control over your financial future. Invest in your financial literacy today!

Investing

A key part of financial literacy is understanding how to make wise investment decisions. This includes knowing how to save money, set aside an emergency fund, and invest in long-term assets. It also includes avoiding debt and managing credit.

Having high levels of financial literacy empowers people to take control of their finances. It can help them become financially independent and build wealth. It can also contribute to a stronger economy, as financially literate individuals are more likely to save money and invest in their future. Moreover, they are less likely to get caught up in unsustainable debt traps. This is why it’s so important to teach kids financial skills early.

Budgeting

Financial literacy focuses on the ability to manage money wisely, including budgeting, managing debt and saving. It also includes understanding financial concepts and principles, such as the time value of money, compound interest, investing and risk.

With increasing life spans leading to longer retirements, complicated health and other insurance options, savings and investment instruments, and a plethora of credit and other financial products available, having strong financial literacy skills has become more critical than ever. It enables people to make better decisions that lead to positive financial outcomes. It can also help them avoid debt traps and develop healthy habits like budgeting and saving.

Taxes

Whether income comes from employment, investment or inheritance, all sources are subject to taxes. Understanding how taxes affect net income is an important aspect of financial literacy.

Educators and financial institutions can work together to develop resources that provide a solid foundation for financial literacy. These resources can include everything from classroom-based activities to downloadable educational materials.

Teaching children financial skills is an exciting adventure that can lead to many smiles and aha moments. Arm your kids with financial literacy to unleash their inner money gurus and set them up for success. Financial literacy also helps prevent devastating mistakes that can have lifelong impacts.

Retirement

Money management skills help people manage their finances and build security. They also enable them to avoid financial pitfalls and reach their goals. These principles include budgeting, saving, investing, taking out loans, and managing debt.

Retirement means different things to everyone, but most people hope for a comfortable life after they stop working. It requires a steady source of income, which can come from Social Security, a pension, or personal savings. It also involves preparing for emergencies, such as a health crisis or the loss of a job. It is important to understand how taxes affect your income, especially when you are saving for a long-term goal like retirement.

Read MoreThe Future of Cryptocurrency Trends and Potential Impacts on Traditional Fi

As cryptocurrencies gain mainstream awareness and adoption, their long-term potential is becoming increasingly clear. Research suggests that crypto ownership is rapidly growing, peaking at 4% of the world’s population in November 2021.

Stablecoins, which are backed by assets or central banks, promise to stabilize value transfers and provide trust in virtual transactions. This aligns well with the principles of the metaverse, enabling users to collaborate and contribute to robust economies in virtual environments.

1. Decentralization

Cryptocurrency is a decentralized system that allows users to verify transactions without the need for a central authority. This makes it secure and resistant to censorship.

As the cryptocurrency sector matures, it will face increasing scrutiny from governing bodies and regulators. This will include more precise regulations regarding crypto exchanges, wallets and mining.

Many governments are considering launching their own digital currencies, known as CBDCs. This could transform traditional finance and help democratize access to financial services.

2. Transparency

The volatility and largely unregulated environment of cryptocurrency markets pose concerns for consumers and investors. Moreover, the lack of laws governing these assets and DeFi enterprises could lead to fraud, cybersecurity risk, and even broader financial stability risks.

Brands that want to avoid becoming a victim of the crypto threat should consider how they can help bridge the gap between traditional fi and the digital currency world. This may be through facilitating trades in a comfortable, safe environment or providing educational content for intenders.

3. Privacy

Cryptocurrencies are often unregulated and can be used for illicit activities. They can also suffer from high volatility and require substantial energy consumption to run their blockchain networks.

Established finance brands can help bridge this gap by offering a more comfortable, safer environment for intenders to invest their money in cryptocurrency while also providing educational content and resources. This can include facilitating trades in existing payment platforms or creating new DeFi applications on public blockchain networks. This could be the start of a new wave of investment in cryptocurrency.

4. Speed

Cryptocurrencies promise to make transferring funds between two transacting parties faster without the need for third party intermediaries. Some examples are flash loans in decentralized finance, which can be executed in seconds.

Consumers expect holistic value propositions that mesh spending, investments and advice with shopping and other aspects of their digital lives. FIs that can deliver on these expectations will win.

As cryptocurrencies gain momentum, it will be important for traditional banks to get on board with digital trends and offer instant mobile services. Otherwise, they may find themselves losing ground to new competitors.

5. Security

Cryptocurrencies are a new paradigm for money. They eliminate the need for centralized intermediaries and allow people to store and transfer value securely.

But they also present risks such as extreme volatility and the lack of regulation. The good news is that knowledgeable regulators can make this innovation work for investors, consumers, and businesses.

6. Efficiency

Cryptocurrencies eliminate the need for centralized intermediaries to enforce trust and police transactions. They also offer more efficient, faster transfer options.

When discussing crypto and financial inclusion, groups like the unbanked or underbanked, Black and Latino or Hispanic communities, get lumped together in reporting, surveys, and crypto industry marketing. However, these groups may have different crypto usage rates and distinct financial needs.

7. Ease of Use

Cryptocurrency is gaining in popularity as it makes money transfers easier and safer. This has led to lawmakers in the US and worldwide establishing laws and regulations that will help bridge the crypto world with traditional financial systems.

Several countries are also exploring central bank digital currencies (CBDC) in an effort to assert sovereignty and get the speed of cryptocurrency without the risks. However, this has yet to be proven successful. Nonetheless, this is one of the crypto trends to watch for 2023.

8. Value

The value of cryptocurrencies is based on a complex set of factors. Some of the more important ones include security, speed and efficiency, and ease of use.

Many of these new cryptocurrency trends aim to improve the underlying mechanisms of trading, lending and investing. They also aim to provide better financial stability safeguards and enhance trust.

Another new trend is stablecoins, which are backed by fiat currency reserves. This has the potential to reduce the volatility of crypto markets and make them more attractive to mainstream investors.

Read MoreIntroduction to Cryptocurrency Exploring the Basics and Benefits

Cryptocurrencies have been a hot investment topic in recent years. They promise to streamline existing financial architecture and decentralize monetary systems.

They’re also complicated, and their prices can fluctuate wildly. This article will help you understand the basics of cryptocurrency. It will also cover the benefits and risks of investing in it.

Basics

Cryptocurrency is digital money that doesn’t rely on a central authority to verify and record transactions. Instead, its value is determined largely by demand and the fact that it’s an asset backed by a public ledger called blockchain.

Crypto transactions are recorded on decentralized computer networks by people with virtual wallets, and this information is publicly accessible. The blockchain is tamper-proof, and the coins cannot be duplicated. Bitcoin is the most well-known cryptocurrency, but there are many others, including Ethereum and Bitcoin Cash.

With cryptocurrencies, the transaction costs are much lower than with traditional bank transfers. This makes them an attractive alternative to fiat currencies like the dollar. Furthermore, the decentralized system eliminates centralized intermediaries, allowing individuals to transact independently of banks and other financial institutions. This is a new paradigm in finance that levels the playing field and could change how we invest, bank, and use money. The potential of cryptocurrencies is enormous, and the technology is poised to revolutionize our world.

Technology

Cryptocurrencies are underpinned by blockchain technology, which creates and maintains an online ledger that records transactions. The system makes it nearly impossible to forge or alter transaction histories, enabling users to buy, sell and trade securely without the involvement of centralized institutions like banks.

There are thousands of different cryptocurrencies created for specific purposes, which can be used to pay for goods or as speculative investments. While they are not backed by government, their prices are volatile and they can be subject to market manipulation and hacking. Additionally, the mining process for Bitcoin can consume huge amounts of electricity, which can have a negative environmental impact.

Bitcoin and other cryptocurrencies represent a new paradigm for money. They streamline existing financial architecture to make it faster and cheaper, and they decentralize monetary systems by removing the need for intermediary institutions to enforce trust and police transactions between parties. Whether this new kind of money will replace traditional currencies remains unclear.

Applications

Cryptocurrencies can be used as digital money over a decentralized computer network between people with virtual wallets. Transactions are recorded on public, tamper-proof ledgers called blockchains. The technology behind blockchains helps prevent double-spending and enables the network to verify transactions without any central authority or middleman.

Blockchains also help to reduce fraud risk by providing a transparent, immutable record of every transaction. This enables market observers to see how the system is functioning and to identify any issues, such as hacks or bad management.

The underlying technology that allows for the creation of cryptocurrencies is called a “distributed ledger”. The blockchain is made up of nodes, which are groups of individuals who contribute to its maintenance and security by accepting new transaction entries into their own copy of the ledger, or by validating these transactions. These nodes are rewarded with cryptocurrency tokens, known as ‘block rewards’. Block rewards are designed to encourage participation by the whole community, ensuring the integrity of the blockchain.

Regulation

Until recently, the crypto industry has operated in something of a regulatory gray area. The market’s volatility and lack of regulation has raised concerns about fraud, tax evasion, cybersecurity, and overall financial stability.

However, the industry is now facing increasing pressure from regulators who are beginning to craft rules for the sector. For instance, the Securities and Exchange Commission has filed a series of lawsuits against crypto companies, alleging that they violate securities laws. This has the potential to significantly alter how individuals can buy and sell cryptocurrencies.

Another challenge is the need for better risk-adjustment tools. For example, cryptocurrency investors aren’t covered by Federal Deposit Insurance or Securities Investor Protection Corporation policies that protect against bank failures and brokerage misdealings. They also don’t have access to the same fundamental information that people who invest in stocks do. These factors can lead to significant losses for investors, especially those from lower income households who were disproportionately hurt by the 2022 collapse in crypto values.

Read MoreAccounting Ethics – A Guide for Accountants and Financial Professionals

Accounting professionals face a variety of ethical pressures. For example, management accountants may be under pressure to present the company’s financial results in a positive light.

They also have access to sensitive financial information about individuals and businesses. Therefore, a strong code of ethics is crucial to the profession.

1. Honesty

Accounting ethics have long been an important part of the profession. In fact, the concept of ethical behavior in accounting dates back to Luca Pacioli, who is considered the father of modern accounting.

Honesty is a fundamental aspect of accounting ethics. Accountants should be transparent and honest with their clients, colleagues and employers at all times. They should also be prepared to stand up for what they believe is right if they feel pressured to violate ethical standards.

Maintaining integrity in accounting is important because it helps prevent fraud. Ethical accountants will be able to identify suspicious activities and report them to the proper authorities, which can save companies from losing money and keep the public safe from financial crimes like embezzlement and misappropriation of funds.

2. Integrity

It’s essential for accountants to be able to trust their team members. Without it, they can’t do their jobs well.

Integrity is more than just being free from conflicts of interest; it’s about adhering steadfastly to a core set of ethical principles and values. This includes being willing to admit when you’ve made a mistake or done something wrong.

It’s also important for accounting professionals to stay up-to-date with best practice, current legislation and new technology in their fields so they can provide clients with reliable and accurate financial information. It’s also crucial that they protect confidential client information by not disclosing it to any third parties without the client’s permission. It’s a good idea to discuss ethics with your team regularly to ensure everyone is on the same page.

3. Fairness

It is generally agreed that the objective of accounting is to present ‘true and fair’ information. This is defined by a standard set by the accounting profession and it is widely accepted that this objective protects users of financial reports.

But this view is a little narrow. It doesn’t address issues of distribution, disclosure or resource allocation considerations which are more pertinent to fairness.

For example, if an accountant is cleverly settling the reimbursement of his favorite employee while leaving others with theirs unpaid, this is a clear case of unfairness. Fairness is a core value for accountants and must be carefully considered in the light of ethical principles. This guide explains how. It also discusses other important ethical concepts like honesty, integrity and independence.

4. Accountability

Accountants must maintain the core accounting values of integrity and objectivity. This means they must be free of personal conflicts of interest and must evaluate financial data objectively. Accountants must also protect their clients’ private information and not share it with outside parties without permission, for profit or for any other reason.

Accountants must also keep up to date with current best practice and laws, as well as seeking professional advice when faced with an ethical dilemma. This will help them make sound ethical decisions and prevent them from engaging in any dishonest or fraudulent practices. This is especially important if they are under pressure from higher level managers.

5. Respect

Accountants play a key role in ensuring financial accuracy. This means they must maintain integrity, confidentiality and professional standards at all times.

Whether they’re at a party or networking event, accountants should be polite and avoid revealing confidential information to non-clients. It’s also important that they respect their colleagues.

One unethical decision can ruin an organisation’s reputation, so it’s vital that the whole accounting team embraces positive ethics at work. This will take strong leadership from management and a buy-in from middle managers.

Accountants must adhere to ICAEW’s code of conduct and abide by the laws, rules and regulations related to the accounting profession. This will help to deter wrongdoing and ensure the public has faith in the accuracy of financial information. It will also reduce legal risk and improve the overall professionalism of the industry.

Read MoreThe Role of Technology in Modern Accounting

Modern accounting is transforming, with technology allowing accountants more freedom, responsibility and time. From cloud-based software to blockchain, the tools available today are more powerful than ever.

This is driving changes in how accounting professionals are trained. They need to demonstrate not only technical skills but also critical thinking and professionalism.

Time-Saving Efficiency

Traditionally, accounting involves gathering information from various sources and inputting it into a central data source. Using technology to automate these manual processes saves time and reduces errors.

Digital document management and storage streamlines information sharing and allows clients to access their accounts anywhere with an internet connection. This technology also reduces the need for physical records, thereby saving both accountants and small-business owners time and money.

Artificial intelligence and machine learning (ML) technologies allow mid-sized firms to better utilize their accounting resources by automating repetitive tasks and reducing the need for human intervention. Additionally, these tools can help with more complex analysis and prediction of trends and patterns.

Streamlining business operations with continuous accounting and real-time execution enhances cash flow, improves reconciliations, and frees up staff to perform higher-level functions, such as analysis and strategic evaluation. This enables businesses to be more competitive in the marketplace. This process is made possible through modern accounting technology, including a cloud-based core system, such as Xero.

Enhanced Accuracy

Accounting is a meticulous and time-consuming process, but with technology tools like automation, cloud computing and data analytics, this work can be accomplished more efficiently and accurately. These tools also help improve communication and collaboration within the accounting team, as well as offer a more streamlined process for recording information in real-time.

For example, incorporating software applications into your accounting processes can automate tasks such as invoice generation and bank reconciliations, freeing up accountants to focus on more complex financial analysis and decision-making for clients. This type of automation helps reduce the risk of human error and can significantly reduce processing times as well.

Additionally, implementing a centralized database with cloud-based accounting software can help eliminate the need for duplicate data entry. This can streamline the accounting process and ensure that all employees are working on the same version of the account. This can reduce the chance of errors and data breaches and increase overall accounting accuracy.

Increased Client Collaboration

Technology can be used to enhance collaboration between accountants and their clients. With tools like real-time integration, cloud computing, data analytics, and cybersecurity, accounting professionals can work smarter and faster.

The use of technology can also automate accounting tasks. Software programs like optical character recognition (OCR) and robotic process automation (RPA) can scan paper documents or digital files and extract information, eliminating the need for manual data entry.

This is a huge time-saver for both the accountants and their clients. It also reduces the risk of errors and mismanagement of funds. This makes it possible for businesses to make informed decisions based on actual financial data. It can also help them avoid regulatory non-compliance and financial fraud. Moreover, it allows accountants to focus on other important aspects of their job like providing financial advice to their clients. This helps them increase client satisfaction and improve their overall business performance. It also leads to a higher rate of customer retention for the accounting firm.

Reduced Risk of Fraud

Technology is a powerful tool that can help to improve accounting processes, reduce errors and even deter fraud. Incorporating technology into accounting helps to keep financial data secure and compliant with relevant regulations, thus reducing the risk of fraudulent activity.

For example, tools like Dext (formerly Receipt Bank) can automate the process of capturing and extracting invoice data, significantly cutting down on manual data entry time. This helps to minimize the risk of human error in a crucial information processing step and frees up accountants’ time to focus on more analytical tasks.

Additionally, platforms like Plooto simplify the payment process by allowing businesses to make electronic payments and eliminates the need for paper cheques, which can be easily forged. The blockchain technology used in cryptocurrencies like Bitcoin also has significant potential to transform the auditing and compliance process by providing a transparent and tamper-proof record of all transactions. This will enhance the reliability of financial reporting, fostering trust among stakeholders.

Read MoreThe Role of Behavioral Finance in DecisionMaking

Understanding personal biases and cognitive processes can help you make better decisions about debt, payments, risks and investments. This is particularly important when it comes to wealth management.

Financial advisors can use behavioral finance tools to address clients’ biases and encourage them to seek diverse perspectives, set realistic goals and monitor their progress.

Emotional Bias

There has been much scientific debate over whether feelings facilitate or interfere with effective decision making. Some scholars argue that feelings are a source of unwanted bias (e.g., regret aversion bias, status quo bias, greed bias), and need to be properly regulated in decision making. Others maintain that feelings per se facilitate and enhance working memory capacity and thus promote decision-making effectiveness (Damasio, 1994).

However, it is important to differentiate between cognitive errors and emotional biases when considering the impact of feelings on decision making. Cognitive errors are primarily due to faulty reasoning and can be addressed through education and training, while emotional biases are more difficult to address because they are rooted in impulse or intuition. Moreover, it has been shown that emotion differentiation is associated with reduced levels of emotional bias. Our results support the latter view, suggesting that individual differences in how people regulate their feelings may determine their overall decision-making performance.

Heuristic Bias

A heuristic is a shortcut that allows a person to engage with their environment quickly and efficiently. Heuristics are useful, but they can also lead to erroneous judgments. The availability bias, representativeness bias, and anchoring and adjustment heuristics are just a few examples of the mental shortcuts that can lead to error in decision-making.

Heuristics are often based on generalizations and rules of thumb, which are fine when they work correctly. But when they do not, they can become real pitfalls in the decision-making process.

For example, Audrey’s heuristics will likely make her think that vitamins are either toxic or harmless. This will influence her initial thought process and cause her to reject the study’s conclusions. This is due to the belief-bias effect, which states that people are more skeptical of a conclusion that seems unbelievable (Evans & Feeney, 2004).

Confirmation Bias

Confirmation bias is the tendency to search for, favor and interpret information in a way that aligns with pre-existing beliefs, expectations or hypotheses. It also causes people to recall supportive information more positively and ignore contradictory evidence.

Almost everyone in a decision-making role, from the receptionist to the CEO, experiences this type of cognitive bias. It is an unavoidable fact of human life, as it is impossible to process all the information that comes at us on a daily basis in an unbiased manner.

The problem with confirmation bias is that it thwarts reliable belief formation and truth tracking. This is particularly true in emotionally charged and deeply entrenched issues. It also causes people to make the halo effect mistake, which is when one’s initial impression of someone or something influences their subsequent impressions. Examples of this are when a teacher may give students who were chosen at random more praise and attention, assuming that they are more promising than the other students.

Framing Bias

Framing is the way options are presented to people. Israeli psychologists Amos Tversky and Daniel Kahneman were the first to systematically study and prove the influence of framing on our decision-making. Their research centered around the concept of prospect theory, which explains how people weigh gains and losses differently.

For example, if you’re selling a new hand sanitizer that kills 99% of germs, it will likely sell better if framed as a gain rather than a loss. You can apply this to any situation where you present the same information in different ways.

Tversky and Kahneman found that when people are offered two identical options—for instance, saving 200 of 600 sailing passengers on a sinking ship or letting them all die—they tend to choose the option that’s framed positively (Program A). They argue this is because the amygdala emits a Pavlovian approach-avoidance signal at the time of choice, thus biasing their choice (see figure below). Other experiments have shown that the effect disappears when choices are presented in a foreign language.

Read MoreBuilding Wealth Through Long Term Investment Strats

Investing is an important part of building wealth. However, it’s critical to know your goals and how much risk you can take as an investor.

Your timeline to invest — the number of years you have between now and retirement — determines your time horizon. The longer your investment horizon, the greater potential for significant monetary gains with less market risk.

1. Diversification

When investing, it’s important to diversify. You may have heard the phrase “don’t put all your eggs in one basket.” Diversification is a simple idea that allows you to spread out risk in your portfolio so that if a single investment goes bad, you don’t lose everything.

You can diversify by separating assets into different asset classes such as stocks and bonds. Then you can divide those asset classes into smaller categories such as industry, geography, and term length. Each of these groups has their own unique risks that you can diversify against.

It’s also possible to diversify within a sector by buying different types of companies. For example, if you’re interested in the transportation industry, you could invest in railroad companies and airlines. This diversifies against changes in the travel industry. However, this does not protect against the inherent or systemic risk that comes with investing in the financial markets. This is why many investors choose to diversify by using funds.

2. Taxes

Building wealth requires a lot of patience and time. Unlike the get-rich-quick schemes that can be tempting, it typically takes decades to build significant wealth through investing. However, there are many strategies that can help you achieve your goal.

One important tactic is saving regularly, which can allow you to grow your assets and keep pace with cost-of-living increases. Another way to save is by using tax-deferred accounts such as an IRA or employer-sponsored retirement account.

While taxes shouldn’t drive investment decisions, taking them into consideration can help you achieve your investing goals more quickly. For example, when rebalancing your portfolio, you may be able to minimize tax costs by shifting funds from higher-taxed accounts to lower-taxed ones.

You can also reduce your tax burden by making use of exchange-traded funds (ETFs), which are investment pools similar to mutual funds. Some ETFs offer lower fees and have less tax impact than individual stocks. You can find these investments through a broker or robo-advisor.

3. Time

Investing is designed to build wealth over time, but it can take years before you see significant monetary gains. The key is to be patient and invest your money in the right financial assets for the long term.

Having a clear plan and establishing financial goals will help you make the most of your investing opportunities. It’s important to monitor your financial health regularly and to rebalance your portfolio when necessary.

Your investment horizon is how long you are willing to hold your investments before you need them back. It can be influenced by personal circumstances and market conditions. Generally, people with long investment horizons can handle more risky investments because they have more time to recover from losses. Those with shorter investment horizons should focus on preserving their capital and may want to avoid investments with a higher risk profile. They should also consider investing in tax-efficient products to maximize their returns.

4. Risk

When you think about risk, skydiving or public speaking may come to mind, but all investments carry some element of risk. While there is a positive correlation between risk and return, you need to balance that against the potential losses resulting from the ups and downs of markets (known as volatility) and the risk of outliving your savings through inflation.

The foundation of your investment pyramid should consist of low-risk investments with foreseeable returns. The middle portion can include medium-risk assets like corporate bonds and blue-chip stocks, and the top portion should consist of higher-risk investments such as growth stocks.

It’s also important to consider your personal goals and time horizon when choosing your investing strategy. If you need access to your funds in the short term, it’s often a good idea to reduce your risk exposure by focusing on conservative investments like cash or short-term government bonds. On the other hand, if you have a long investing horizon to work with, you can take more risks to try to achieve a higher return over time.

Read MoreInvesting in the Stock Market – Tips for Beginners and Common Pitfalls to Avoid

Investing in the stock market, also called equities, is one of the best ways to grow your money over time. But picking the right stocks is easier said than done.

You’ll need to carefully plot out your short-, medium-, and long-term goals and time horizons; understand the difference between investing and trading; and avoid common pitfalls like buying high and selling low.

1. Don’t Be Afraid to Diversify

There are many reasons why investing in the stock market is a great way to grow your wealth and secure your financial future. But before you start investing, it is important to understand a few basics.

For starters, it is important to diversify your investments. This means buying stocks from different companies and industries, as well as making sure to spread your investments across multiple geographic regions. It also means not putting all of your eggs in one basket, by having a savings account or other fixed-income investment to help cushion you from any major market declines.

Another good practice is to avoid short-term trading. This type of trading is generally done by day traders and can be very risky. Instead, you should focus on long-term investments such as low-cost index funds and ETFs, which can give you a diversified portfolio for a very affordable price. The average annual return on these types of investments is around 10%, but remember that the market can go down as well as up.

2. Don’t Be Afraid to Look for Trends

Investing in stocks, also known as equities, gives you ownership of public companies. This equity gives you a real stake in the company and its profitability. But before you jump into investing, make sure to understand the basic metrics of a stock.

You should know how much you earn, spend, have saved and owe so that you can determine whether you have enough money to start investing. Then you can figure out your investment goals and risk tolerance. You can ask trading experts or read financial news to learn more about investing.

A common mistake beginners make is chasing the trends in the market. Whether it’s a frenzy over GameStop or the latest cryptocurrency, you should always look at the big picture before making any investments. Remember, investing is a long-term activity, and you need to have plenty of time to ride out market fluctuations. Trying to catch the next big thing could cost you your capital.

3. Don’t Be Afraid to Ask Questions

Investing in the stock market is a great way to build wealth, but it’s not without risk. That’s why it’s important to ask questions when investing your money, such as how much return you can expect and what fees you might pay. You should also make sure that you understand the basic concepts of stock market investing, including diversification and dollar-cost averaging.

Buying shares in a publicly-traded company confers partial ownership and a slice of the company’s earnings. Before you invest, take the time to research a company’s financial health and performance, read news stories about it, and look at its historical stock prices.

The bottom line is that you should never invest money that you may need in the near future or that you cannot afford to lose, especially if you’re new to investing. Remembering the basics of investing can help you avoid common pitfalls and build your wealth journey faster. You can start by opening a brokerage account, which is an online savings or investment account.

4. Don’t Be Afraid to Ask for Help

The stock market is a great way to diversify your investment portfolio. It can also provide a better return than other investments, such as certificates of deposit or Treasury bonds. In fact, stocks have typically returned more than 10% annually over the past century, which is much higher than long-term inflation.

There are a number of ways to invest in stocks, including through an online brokerage account. You can choose to buy your own stocks directly, or you can hire a financial advisor or robo-advisor to do it for you. NerdWallet has a tool that rates online brokers and robo-advisors based on fees, minimums, investment choices, customer support and mobile app capabilities.

Before you start investing, be sure to get your finances in order. It’s important to know how much money you earn, spend, have saved and owe in order to determine if you can afford to invest. You should also consider your financial goals and risk tolerance.

Read MoreTax Planning Strategies for Individuals and Businesses Maximizing Deduction

Although everyone’s tax picture is unique, there are a number of common strategies that can help minimize your income taxes. Staying up to date with deductions and credits as they emerge is vital.

One way to minimize your taxes is to bunch your itemized deductions into one year. This strategy can allow you to exceed the standard deduction thresholds and claim a higher deduction.

Depreciation

Depending on how you organize your expenses, it’s possible to save a substantial amount in taxes. By bunching certain expenses together, you can increase your chances of exceeding the standard deduction amount and itemizing deductions.

Depreciation is a valuable business tax planning strategy that allows you to write off property over time, reducing your taxable income. In some cases, it’s more advantageous to use accelerated depreciation methods like MACRS, which allow you to take a larger deduction in the first years of ownership and a smaller write-off later on.

Other business tax planning strategies include choosing the proper entity, utilizing employee benefits and compensation, and tracking and maintaining assets. It’s also important to stay up-to-date on new tax laws and regulations to identify new tax-saving opportunities. Moreover, hiring a professional tax planning services expert can help you optimize your business financial performance and maximize your deductions. They can provide you with expert guidance and assistance, ensure compliance with regulations and help you stay ahead of new deduction opportunities.

Business Interest Deductions

Before the Tax Cuts and Jobs Act, interest expense was a fully deductible business expense. Now, the law limits this deduction, except for small businesses and agribusinesses that elect to deduct floor plan financing interest. As a result, businesses may need to reconsider their financial and tax positions.

To minimize the impact of the business interest limitation, consider accelerating income toward the end of the year. This strategy works for pass-through entities (partnerships, S corporations, and sole proprietorships), since any excess interest expense is passed through to the partners and offset against their individual taxable income.

Another option is to prepay expenses at the end of the year, as long as they are eligible expenses and they do not exceed IRS limitations. Be sure to consult with your accountant before executing this strategy. They can help you identify eligible expenses and determine if you are at or near your limit. They can also help you understand the impact of the new law on your business.

Charitable Contributions

Individuals can get valuable tax savings by making charitable donations of cash and noncash assets, including long-held appreciated securities and real estate. The fair market value of the donation can be deducted up to 60% of adjusted gross income for itemizers.

Individual taxpayers can boost their deduction by bunching donations together into one year. This strategy may help them exceed the standard deduction and increase their ability to claim other itemized deductions like medical expenses, 529 plan contributions and home interest expense.

Smart tax planning for individuals and businesses can help them minimize their taxes and put more money in their pockets. By working with a qualified financial professional, you can devise strategies that fit your unique situation and goals. A strategic approach now can reap bountiful rewards in the future.

Capital Gains

Investment gains are taxed at a higher rate than ordinary income, but there are strategies that can help you mitigate capital gains taxes. One strategy is known as “tax gain-loss harvesting.” It involves selling investments that have lost value and using those losses to offset taxable gains. In addition, unused investment losses can be carried forward indefinitely to offset future taxable gains and ordinary income.

For businesses, the right business entity structure can minimize the amount of taxes owed come Tax Day. Then there are strategies like leveraging government credits and incentives, bunching expenses (like charitable donations) or utilizing foreign tax credits.

Individuals can also reduce their lifetime tax rate by deferring compensation from high-tax working years into low-tax nonworking years, such as retirement. And a tax-efficient strategy for leaving assets to heirs is to use a qualified plan, like a Roth 401(k) or IRA. All of these strategies require careful planning and should be implemented with an advisor who understands your complete financial picture.

Read MoreTax Reform Updates Key Changes and Implications for Taxpayers

The TCJA cuts taxes for individuals and businesses, but it also reduces revenues. In particular, the expanded standard deduction and repeal of the Net Investment Income Tax (NIIT) reduce revenue by $4.0 trillion over 10 years.

Moreover, the reopening of the code in 2025 necessitates important fiscal trade-offs. Policymakers should pursue true reform that avoids the regressivity of this law and accords more favorable treatment to working families.

Taxes on Pass-Through Income

The 2017 tax law created a 20% deduction for certain income from pass-through entities (partnerships, S corporations, and sole proprietorships) that owners report on their individual returns. Previously, this income was taxed at the same rates as wages and salaries. This new deduction is skewed in favor of higher-income individuals, and research suggests that it does not encourage real economic activity. On a conventional basis, it will reduce federal tax collections by $700 billion over the next ten years.

The framework also adjusts many of the tax rules to help Americans avoid “bracket creep” – when they find themselves paying higher taxes in future years as their inflation-adjusted incomes rise, even though their actual standard of living has not changed. It also doubles the standard deduction, helping families keep more of their paycheck. The tax code would be fairer and simpler, putting more money in the pockets of middle-class families. It would also help businesses invest in their local communities and grow their paychecks.

Capital Gains and Dividends

Investors realize capital gains when they sell investments held for more than a year. The amount of the gain is the difference between the original cost of the investment (plus adjustments) and the selling price. Investors also receive dividend income when companies distribute earnings to shareholders. These are usually considered ordinary income or qualified dividends and taxed at preferential rates compared to other types of income.

Under current law in 2020, long-term and short-term capital gains are taxed at 0 percent or 15 percent depending on a taxpayer’s filing status and taxable income level. Taxpayers with modified adjusted gross income above certain levels owe an additional 3.8 percent net investment income tax (NIIT) on long- and short-term capital gains and qualified dividends.

Investors who primarily seek dividend income may want to work with a financial advisor to weigh the pluses and minuses of focusing on dividends or capital gains. Investors with a mix of both can take advantage of a strategy known as “tax-loss harvesting,” which involves selling stocks that have lost value to offset the gains realized by other stocks in their portfolio.

Taxes on Interest Expenses

The tax code is a patchwork of deductions, credits and other preferences that imposes an inherent bias against saving and investment. This bias is exacerbated by an income tax that taxes both the returns on savings and the benefits of delayed consumption.

While major reform proposals have failed to pass Congress, many changes were included in the Inflation Reduction Act that gained Congressional approval in August 2022 and the SECURE 2.0 Act approved in December 2022. Consequently, taxpayers should be aware of the potential impact on their tax bills and financial decisions from these new provisions.

Taxpayers should also remain mindful of the fact that several tax benefits put into place in 2017 are closing in on their sunset dates, and that inflation adjustments for 2024 will affect some items including the standard deduction and tax brackets. With so much uncertainty in Washington, it is difficult to predict how Congress and the Administration will handle future attempts at tax reform.

Taxes on Investment Income

With taxes as a major factor in investment decisions, many individuals and investors want to understand how the new tax law impacts their investments. This page aims to provide a summary of key changes and implications for taxpayers under the new tax code.

The reform increases the standard deduction and expands the child tax credit, making it more likely that families will receive significant after-tax savings. The reform also reduces marginal income tax rates moderately for most middle-class taxpayers and by half for many high-income taxpayers, which will encourage work, savings, and investment.

It reduces the maximum corporate tax rate to 20%, below the average in the industrialized world. It also eliminates most individual tax expenditures and replaces the book minimum tax with a distributed profits tax similar to Estonia’s, which will help businesses compete globally.

In addition, it establishes a comprehensive market state tax sourcing regime that will facilitate the relocation of companies to New York and encourage companies to locate here to capitalize on our skilled workforce and robust technology infrastructure. These provisions will be effective beginning in 2024.

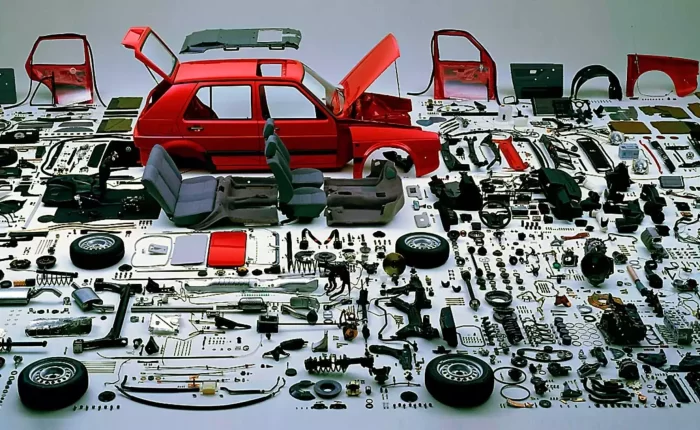

Read MoreStrategies for Effective Project Management From Planning to Execution

Project management helps companies break projects down into smaller, manageable components. This allows for clear goals and expectations to be set.

It also eliminates confusion about what needs to be done and when. This enables employees to prioritize work, and ensure that they have enough time and resources to complete their assigned tasks.

1. Prioritize and Delegate

The planning stage of project management helps you set SMART goals for the overall project, prepare for unexpected changes, and develop a roadmap for project success. It also helps you define and communicate the project’s scope to team members so everyone knows what is expected of them.

When it comes to the execution phase, successful project managers prioritize and delegate tasks effectively. This helps ensure that important tasks get done and that high-impact work is completed by the right people.

When prioritizing, consider the amount of time and resources each task will take to complete. You can use a popular task-management matrix such as the Eisenhower Matrix to evaluate each task’s importance and urgency and place them in corresponding quadrants.

2. Plan for Variances

Project managers need to be prepared for changes to the timeline and budget. By regularly conducting variance analysis, they can identify the reasons behind project deviations and take corrective actions to bring them back in line with the original plan.

For example, if your construction project is running behind schedule, it might be necessary to negotiate with stakeholders to secure additional funding or find ways to cut costs elsewhere in the budget. It’s also important to communicate with your team about the situation and provide context, so everyone is on the same page.

3. Identify and Manage Risks

During the project planning process, identify potential risks and assess how they could impact your project’s timeline, budget, quality, or other important factors. Use a risk assessment matrix to determine how likely each risk is to occur, and the level of impact it could have.

Brainstorm with your project team to identify possible risks. This will help you avoid surprises and keep the project on track. Prioritize each risk based on its likelihood and severity. Focus on the most serious risks and develop contingency plans to mitigate them.

5. Communicate Early and Often

The key to success with any project is communication. Creating a communication plan during the planning phase can help your team stay on track and keep stakeholders updated throughout the process.

This includes planning how often your team will meet to discuss progress, when status reports are due, and identifying what information is most important to each stakeholder. Having this documented helps ensure that your team is working on what matters and makes it easier for you to see where problems might arise.

It is also critical to manage risk and expectations. Having a plan in place to do so can make the difference between an unfavorable outcome and an outstanding project.

6. Build a Strong Team